The global aerospace parts manufacturing industry, a critical contributor to modern aviation, is anticipated to experience significant growth in the coming years. The sector is set to overcome the challenges posed by the COVID-19 pandemic, with robust recovery driven by increasing demand for new aircraft, advancements in technology, and the growing need for replacement parts and maintenance. This article provides an in-depth analysis of the market, highlighting key trends, opportunities, and challenges shaping its projected trajectory from 2023 to 2033.

Market Overview and Dynamics

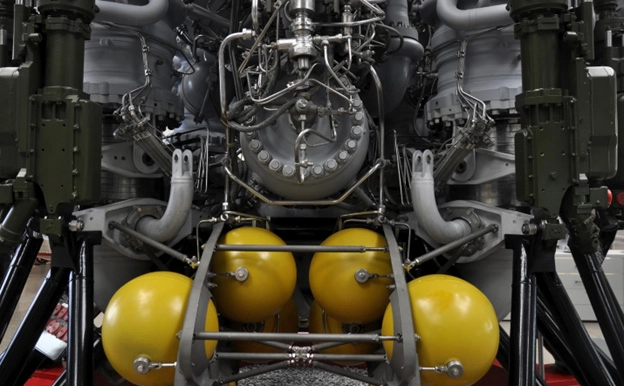

The aerospace parts manufacturing industry is a vital segment within the broader aviation sector, producing critical components for different types of aircraft, including commercial planes, space rockets, satellites, business jets, and military aircraft. These parts, ranging from engines and avionics to cabin interiors and insulation components, are produced using advanced manufacturing techniques that ensure precision, durability, and reliability.

The global aerospace parts manufacturing market, valued at US$ 910 billion in 2023, is projected to grow at a compound annual growth rate (CAGR) of 3.6% over the next decade, reaching US$ 1,297 billion by 2033. This growth is largely driven by the increasing number of air passengers and the subsequent rise in demand for new aircraft. Other contributing factors include advancements in material science, the advent of 3D printing in aerospace manufacturing, and growing investments in military aviation.

However, the industry is not without its challenges. Fluctuations in the cost of components and stringent regulatory environments can hamper market growth. Moreover, the COVID-19 pandemic caused a significant downturn in the sector due to strict travel restrictions and economic downturns. Yet, industry players are steadily overcoming these hurdles, strategically positioning themselves for sustained growth in the post-pandemic era.

Key Market Drivers

Rising Demand for Aircraft Maintenance and Replacement

One of the primary growth drivers for the aerospace parts manufacturing industry is the increasing demand for aircraft maintenance and replacement. As commercial airlines, military aircraft, and general aviation operations continue to expand, the need for high-quality, reliable aircraft components escalates. Furthermore, with aircraft often exposed to harsh environmental conditions, the need for regular maintenance and part replacement is paramount, ensuring operational safety and efficiency.

One of the primary growth drivers for the aerospace parts manufacturing industry is the increasing demand for aircraft maintenance and replacement. As commercial airlines, military aircraft, and general aviation operations continue to expand, the need for high-quality, reliable aircraft components escalates. Furthermore, with aircraft often exposed to harsh environmental conditions, the need for regular maintenance and part replacement is paramount, ensuring operational safety and efficiency.

Emergence of Composite Materials in Aerospace Manufacturing

The introduction of composite materials in aerospace manufacturing is revolutionizing the industry. These lightweight, durable materials, such as carbon-fiber composites, are increasingly used in various aircraft components, including fuselage, doors, tail surfaces, and wings. They not only reduce the weight of the aircraft but also enhance fuel efficiency and overall performance.

Market Challenges

Fluctuating Costs of Components

The cost of aerospace components is a crucial determinant of the market’s supply and demand dynamics. Macroeconomic and microeconomic factors often cause fluctuations in these costs, which can hamper demand. High manufacturing costs, in particular, can create barriers for market development, making it difficult for manufacturers to maintain competitive pricing.

Impact of COVID-19 Pandemic

The COVID-19 pandemic has had a significant impact on the aerospace parts manufacturing industry. With international flights grounded and demand for air travel plummeting, airlines faced massive losses, disrupting aircraft production operations. This, in turn, affected investments and projects centered around aerospace parts manufacturing. However, as restrictions ease and the industry recovers, the market is expected to regain momentum.

Growth Opportunities

Increasing Use of Predictive Maintenance

Predictive maintenance, powered by big data and analytics, is transforming the aviation industry. By leveraging flight-recorded data, airlines can significantly reduce maintenance expenditures and enhance operational efficiency. This trend is creating unique growth opportunities for aerospace parts manufacturers, enabling them to meet evolving industry requirements.

Predictive maintenance, powered by big data and analytics, is transforming the aviation industry. By leveraging flight-recorded data, airlines can significantly reduce maintenance expenditures and enhance operational efficiency. This trend is creating unique growth opportunities for aerospace parts manufacturers, enabling them to meet evolving industry requirements.

Market Segmentation

The global aerospace parts manufacturing market can be segmented based on product type and aircraft type. By product type, the market is divided into engines, aircraft manufacturing, cabin interiors, equipment, systems, and support, avionics, and insulation components. The insulation components and equipment segment dominated the market in 2022, accounting for approximately 22.82% of the market share.

In terms of aircraft type, the market is segmented into commercial aircraft, business aircraft, military aircraft, and others. The commercial aircraft segment dominated the market in 2022, accounting for around 56.78% of the market share. The rise in domestic and international air travel, coupled with the growing production of low-cost carriers, is expected to drive growth in this segment.

Regional Analysis

From a geographical perspective, the global aerospace parts manufacturing market is segmented into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America, with a market revenue share of 36.03% in 2022, is expected to dominate the market, driven by the active adoption of advanced aerospace technologies and the presence of prominent aerospace companies.

Asia-Pacific is expected to witness significant growth, driven by the rising demand for air travel, increasing production of low-cost carriers, and the growth of the domestic aerospace parts manufacturing industry. On the other hand, political instability and low economic development may hinder market growth in the Middle East & Africa, and Latin America.

Key Players and Competitive Analysis

The global aerospace parts manufacturing market is highly competitive, with key players focusing on adopting new technologies, innovating products, and engaging in strategic mergers and acquisitions, alliances, and partnerships to strengthen their market position.

Key players in the market include Safran Group, GE Aviation, Diehl Aviation, Boeing, Intrex Aerospace, Lufthansa Technik AG, Honeywell International Inc., Liebherr International AG, Thales Group, Dassault Group, Textron Inc., Raytheon Technologies Corp., Rolls Royce plc, CAMAR Aircraft Parts Company, and others.

Conclusion

The global aerospace parts manufacturing market is poised for substantial growth in the coming decade. Despite the challenges posed by the COVID-19 pandemic and fluctuating component costs, the industry is set to rebound, driven by increasing demand for new aircraft, advancements in technology, and the growing need for replacement parts and maintenance. As the industry navigates these dynamics, the focus will be on adopting advanced manufacturing techniques, exploring new materials like composites, and leveraging technologies and predictive maintenance.

Citations:

https://www.factmr.com/report/4552/aerospace-parts-manufacturing-market

https://www.thebrainyinsights.com/report/aerospace-parts-manufacturing-market-12667

https://finance.yahoo.com/news/aerospace-parts-manufacturing-market-size-104400250.html?guccounter=1